- Analisis

- Analisis teknis

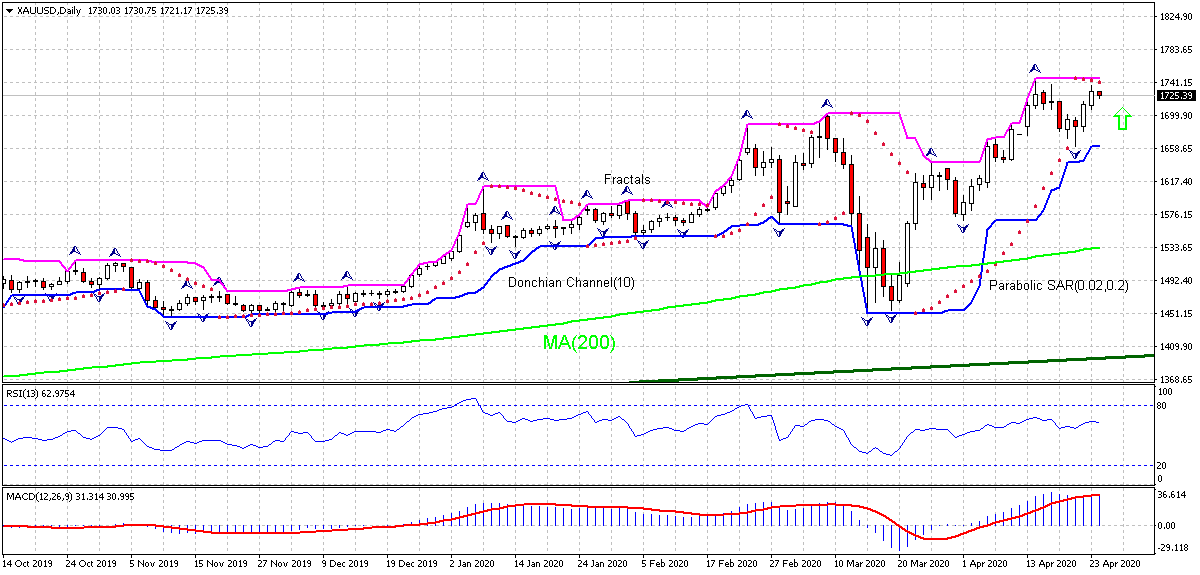

Gold Analisis teknis - Gold Jual beli: 2020-04-24

Gold Technical Analysis Summary

Atas 1746.98

Buy Stop

Bawah 1661.20

Stop Loss

| Indicator | Signal |

| RSI | Neutral |

| MACD | Buy |

| Donchian Channel | Neutral |

| MA(200) | Buy |

| Fractals | Buy |

| Parabolic SAR | Buy |

Gold Chart Analysis

Gold Analisis Teknis

On the daily timeframe XAUUSD: D1 is rising above the 200-day moving average MA(200), which is rising itself. We believe the bullish momentum will continue after the price breaches above the upper boundary of Donchian channel at 1746.98. A level above this can be used as an entry point for placing a pending order to buy. The stop loss can be placed below 1661.20. After placing the order, the stop loss is to be moved every day to the next fractal low, following Parabolic signals. Thus, we are changing the expected profit/loss ratio to the breakeven point. If the price meets the stop loss level (1661.20) without reaching the order (1746.98), we recommend cancelling the order: the market has undergone internal changes which were not taken into account.

Fundamental Analysis Logam Mulia - Gold

Uncertainty that followed the coronavirus outbreak boosted safe haven demand. Will the XAUUSD climbing continue?

Recent US economic data were dismal. The Labor Department report implied more than 25 million Americans sought unemployment benefits over the last five weeks. And Markit’s report indicated US manufacturing sector continued contracting in April. As businesses around the globe struggle to keep afloat under conditions of shutdowns, major industrial economies’ governments adopted monetary and fiscal stimulus programs to prop flailing economies. Thus, the Federal Reserve added $1.5 trillion of liquidity to the financial system on March 12 to stabilize money markets. It restarted the Quantitative Easing program on March 15 with the purchase of $500 billion in treasuries and $200 billion in mortgage-backed securities. The Federal Reserve expanded its asset purchases of both treasuries and mortgage-backed securities by an additional $625 billion on March 23. On April 9, The central bank announced new loan program totaling $2.3 trillion. On the fiscal side US administration launched a $2 trillion Phase Three stimulus bill On March 25 including direct cash payments to population , loan program to companies impacted by the outbreak, federally guaranteed small business loans , expansion of unemployment insurance, business tax cuts, funding to state governments and public programs. This Tuesday Senate passed another coronavirus relief package worth nearly $500 billion to replenish funds for small businesses. The European Central Bank announced on March 19 it will purchase roughly $800 billion of additional bonds throughout 2020 in excess of $128 billion announced on March 12. The Bank of Japan announced on March 16 a doubling of the rate at which it was purchasing Exchange Traded Funds from $56 billion a year to $112 billion. The uncertainty that followed the coronavirus outbreak and massive monetary stimulus programs have boosted safe haven demand which is bullish for XAUUSD.

Perhatian:

Tinjauan ini memiliki karakter informatif dan tutorial dan dipublikasikan secara gratis. Semua data, termasuk dalam Tinjauan, diterima dari sumber publik, diakui kurang lebih dapat diandalkan. Apalagi, tidak ada jaminan bahwa informasi yang ditunjukkan penuh dan tepat. tinjauan tidak diperbarui. Keseluruhan informasi dalam setiap tinjauan, termasuk pendapat, indikator, grafik dan hal lainnya, disediakan hanya untuk tujuan pengenalan dan bukan saran keuangan atau rekomendasi. Seluruh teks dan bagiannya, serta grafik tidak dapat dianggap sebagai tawaran untuk membuat kesepakatan dengan aset apa pun. Pasar IFC dan karyawannya dalam kondisi apapun tidak bertanggung jawab atas tindakan yang dilakukan oleh orang lain selama atau setelah membaca tinjauan.