- Perdagangan

- Syarat perdagangan dan swap

- Pustaka Instrumen Sintetis

- Investasi Indeks mata uang CAD

Dagang Indeks mata uang CAD - &CAD_Index

Investasi Indeks mata uang CAD

Jenis:

PCIInstrumen : &CAD_Index

Deskripsi CAD / Currencies

The currency index is used for analysis and trading of the Canadian dollar CAD against the rest of the Forex market. A portfolio of most liquid currencies is used as a market systemic indicator: EUR, USD, GBP, AUD, CHF, JPY. Валютный индекс предназначен для анализа и торговли канадским долларом CAD против остального сегмента валютного рынка Forex. В качестве системного индикатора рынка используется портфель наиболее ликвидных валют: EUR, USD, GBP, AUD, CHF, JPY.

Manfaat

The following are the advantages of the currency index &CAD_Index : (a) the index reaction to the fundamental events in Canada’s economy is the most obvious and stable, (b) the index sensitivity to fundamental events in other currency zones is minimal, which allows to detect low-volatility trend movement of the index that characterizes objectively the state of Canada’s economy. The theoretical bases for the component composition of the index can be found below in the section “Application field."

Struktur

Parameter

Jam Perdagangan

Application field

Struktur

| &CAD_Index | № | Aset | Volume / 1 PCI | Persentase | Volume (USD) / 1 PCI | Unit pengukuran |

|---|---|---|---|---|---|---|

| Bagian dasar | 1 | CAD | 1005.9120 | 80.000 | 800.0000 | CAD |

| Bagian kutipan | 1 | AUD | 251.214 | 19.5500 | 195.5000 | AUD |

| 2 | CHF | 179.694 | 19.5500 | 195.5000 | CHF | |

| 3 | EUR | 164.354 | 18.6400 | 186.4000 | EUR | |

| 4 | GBP | 129.535 | 19.5500 | 195.5000 | GBP | |

| 5 | JPY | 23031.924 | 19.5300 | 195.3000 | JPY | |

| 6 | USD | 31.800 | 3.1800 | 31.8000 | USD |

Parameter

| Standard | Beginner | Demo | |

|---|---|---|---|

| Spread Tetap dalam pips | |||

|

Spread Mengambang dalam pip | |||

| Jarak Order dalam pips | |||

|

Swap dalam pips (Panjang/Pendek) | |||

|

Volume tersedia | |||

| Nilai 1 pip dalam USD untuk Vol |

Jam Perdagangan

| Hari kerja | Jam perdagangan (CET) | Jam trading lokal |

| Senin | — | — |

| Selasa | — | — |

| Rabu | — | — |

| Kamis | — | — |

| Jumat | — | — |

| SAT | — | — |

| Minggu | — | — |

Application field

In the foreign exchange turnover study carried out by the Bank of International Settlement in April 2013 7 leading currencies, which we have included for considering, stand out in monthly exchange turnover volumes.

| Currency | Turnover share, % |

|---|---|

| USD | 43.5% |

| EUR | 16.7% |

| JPY | 11.5% |

| GBP | 5.9% |

| AUD | 4.3% |

| CHF | 2.6% |

| CAD | 2.3% |

Тable 1. Central bank foreign turnover. April 2013.

In the right hand column the respective shares of currencies in the foreign exchange turnover of regulators are presented in descending order.

In creating the index we consider (quote) CAD against “portfolio standard”, composed of 6 remaining liquid currencies: USD + GBP + EUR + AUD + CHF + JPY. The weight optimization is carried out so that the standard possesses the minimum sensitivity with respect to the events in Canada. The weights, which correspond to the quoted standard, are selected on the basis of currency zone “non-interference” principle.

Let us explain the application of that principle. The table of liquid currency priority for foreign exchanges quoted against CAD is made on the basis of foreign exchange turnover 2013 study where we apply a numerically small value 0.1% for the turnover share of the currencies not presented in the source.

| Currency pair | Turnover share, % | Residual influence share, % |

|---|---|---|

| USD/CAD | 3.7 | 0.7 |

| GBP/CAD | 0.1 | 4.3 |

| AUD/CAD | 0.1 | 4.3 |

| CAD/CHF | 0.1 | 4.3 |

| EUR/CAD | 0.3 | 4.1 |

| CAD/JPY | 0.1 | 4.3 |

Тable 2. Currency pair monthly turnover. April 2013.

The total share of CAD turnover relative to the liquid instruments under consideration is 22.2%. Then the residual share is equal to the difference between the total share and the currency pair share.

The residual share characterizes the currency (CAD) stability with respect to changes in the price of the quoted part. Indeed, in order to introduce significant volatility into the index the participation of remaining “counterpart” currencies (CAD vs X) is required with the weights equal to their share in the foreign exchange operations. Therefore the values from the right hand column of the Table 2 were applied for determining the currency weights for creation of the index.

Let us remind that the structure of the index can be represented as follows:

CAD / ( W1*USD + W2*GBP + W3*AUD + W4*CHF + W5*EUR + W6*JPY )

We shall take the Wi weights for the standard proportional to the residual influence share (the right hand column of the Table 2). Thus, we are raising the index stability with respect to events in Canada. Then the index sensitivity will be determined by the base part – CAD. The estimates yield the percentage composition of the portfolio, presented in the Structure table.

The instrument & CAD _Index is highly sensitive with respect to fundamental changes in Canada’s economic development and therefore well suited for trend following strategy in periods when key fundamental events are anticipated.

In NetTradeX trading platform buying the instrument means capital allocation between a long position in CAD and a short position in the portfolio standard.

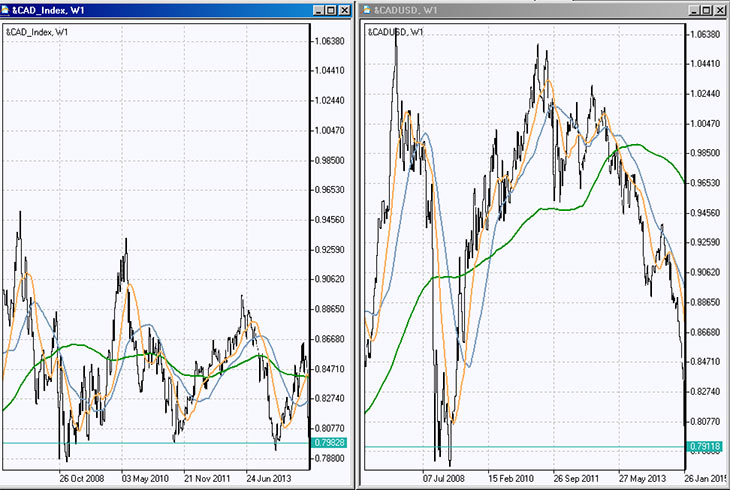

&CAD_Index can be used for comparative analysis of the index vs. the instrument &CADUSD (the reciprocal of the popular currency pair USDCAD), by building, for example, a percentage chart in the NetTradeX terminal for the two instruments (Fig.1) and studying the price dynamics during 2014. It is evident that since the end of the summer of 2014 the Canadian dollar and American dollar currency pair started to fall much faster than the index, which allows to make a conclusion, for example, that the USD was the main contributor to the fall.

Fig. 1

By comparing the price dynamics of the index and the currency pair for long-term trade (Fig.2) it is evident that the CAD index range (on a weekly timeframe) is two times smaller than the &CADUSD range.

Fig. 2

Traders, who specialize in fundamental analysis and focus on the developments in Canada’s economy and want to filter out the influence of other currency zones will be comfortable trading this instrument.

Perdagangan instrumen PCI ditawarkan secara eksklusif oleh IFC Markets, Anda harus membuka akun gratis dan mengunduh platform NetTradeX.

- Klien Juga Melakukan Perdagangan Instrumen Ini