- Analisis

- Sentimen Pasar

Weekly Top Gainers/Losers: New Zealand dollar and Swiss franc

Top Gainers – The World Market

Top Gainers – The World Market

Prices for various goods and raw materials continued to climb over the past 7 days. This led to the strengthening of the commodity currencies: Australia and New Zealand. The yield on US 10-year bonds has been actively growing since early 2021. Within this period it increased from 0.9% to 1.49% per annum, and over the week - from 1.34% to 1.45%. This could have contributed to the weakening of the Swiss franc. The yield on 10-year Swiss government bonds is negative and one of the lowest in the world, at -0.23% currently.

1.American Airlines Group Inc., 22,6% – American airline

2. Alcoa Corp., 21,3% – American aluminum producer

Top Losers – The World Market

Top Losers – The World Market

1. PetróleoBrasileiro S.A. - Petrobras – Brazilian oil company

2. Sharp Corporation – Japanese electronics manufacturer

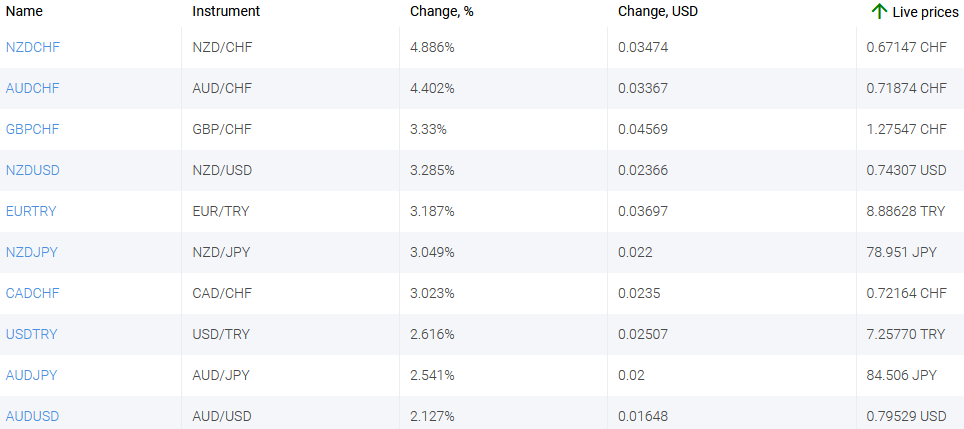

Top Gainers – Foreign Exchange Market (Forex)

Top Gainers – Foreign Exchange Market (Forex)

1. NZDCHF, NZDUSD - the growth of these charts means the strengthening of the New Zealand dollar against the Swiss franc and the US dollar.

2. AUDCHF, GBPCHF - the growth of these charts means the weakening of the Swiss franc against the Australian dollar and the British pound.

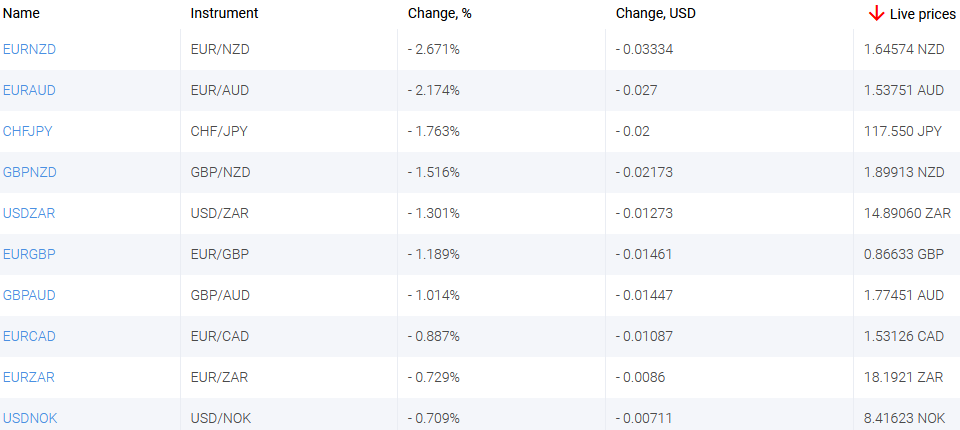

Top Losers – Foreign Exchange Market (Forex)

Top Losers – Foreign Exchange Market (Forex)

1. EURNZD, EURAUD - the drop in these charts means the weakening of the euro against the New Zealand and Australian dollars.

2. CHFJPY, GBPNZD - the drop in these charts means the weakening of the Swiss franc against the Japanese yen and the British pound against the New Zealand dollar.

Alat Analisis Eksklusif Baru

Setiap Rentang Tanggal - dari 1 hari sampai 1 tahun

Setiap Kelompok Perdagangan - Forex, Saham, Indeks, dll.

Perhatian:

Tinjauan ini memiliki karakter informatif dan tutorial dan dipublikasikan secara gratis. Semua data, termasuk dalam Tinjauan, diterima dari sumber publik, diakui kurang lebih dapat diandalkan. Apalagi, tidak ada jaminan bahwa informasi yang ditunjukkan penuh dan tepat. tinjauan tidak diperbarui. Keseluruhan informasi dalam setiap tinjauan, termasuk pendapat, indikator, grafik dan hal lainnya, disediakan hanya untuk tujuan pengenalan dan bukan saran keuangan atau rekomendasi. Seluruh teks dan bagiannya, serta grafik tidak dapat dianggap sebagai tawaran untuk membuat kesepakatan dengan aset apa pun. Pasar IFC dan karyawannya dalam kondisi apapun tidak bertanggung jawab atas tindakan yang dilakukan oleh orang lain selama atau setelah membaca tinjauan.

Last Sentiments

- 18Mar2021Weekly Top Gainers/Losers: Canadian dollar and Japanese yen

Over the past 7 days, prices for oil, non-ferrous metals and other mineral raw materials decreased but still remained high. As a result, the currencies of the commodity countries strengthened: the Canadian dollar, the Australian and New Zealand dollars, the Mexican peso, and the South African rand. The...

- 10Mar2021Weekly Top Gainers/Losers: Canadian dollar and New Zealand dollar

Оil quotes continued to rise over the past 7 days. Against this background, the currencies of oil-producing countries, such as the Russian ruble and the Canadian dollar, strengthened. The New Zealand dollar weakened after the announcement of negative economic indicators: ANZ Business Confidence and...

- 4Mar2021Weekly Top Gainers/Losers: American dollar and South African rand

Over the past 7 days, oil quotes continued to grow. Precious metals, including gold, fell in price. Against this background, the shares of oil companies increased, the Russian ruble strengthened, the Australian and New Zealand dollars, as well as the South African rand, weakened. The US dollar strengthened...