- Analisis

- Sentimen Pasar

Weekly Top Gainers/Losers: Australian Dollar and US Dollar

Top Gainers – The World Market

Top Gainers – The World Market

The US dollar weakened noticeably over the past 7 days. Investors fear a rise in inflation in the USA amid large-scale measures to stimulate the American economy. Against the backdrop of continued growth in global prices for oil, copper and non-ferrous metals, the commodity-based currencies such as the Russian ruble, the South African rand, the Australian dollar, the Norwegian krone have strengthened. The Turkish lira was supported by the increase in the rate of the Central Bank of Turkey at the end of 2020 to 17%. At the same time, the Central Bank of Turkey intends to keep high rates until 2023 and expects inflation to drop to 10% by the end of 2021.

1.Mitsubishi Motors Corporation, 27,6% – japanese automobile company

2. Kobe Steel, Ltd., 27% – japanese steel company

Top Losers – The World Market

Top Losers – The World Market

1. Origin Energy Ltd – Australian electricity and gas producer

2. Unilever PLC – British manufacturer of food and consumer products

Top Gainers – Foreign Exchange Market (Forex)

Top Gainers – Foreign Exchange Market (Forex)

1. AUDUSD, AUDJPY - the growth of these charts means the weakening of the US dollar and the Japanese yen against the Australian dollar.

2. AUDNZD, GBPNZD - the growth of these charts means the weakening of the New Zealand dollar against the Australian dollar and the British pound.

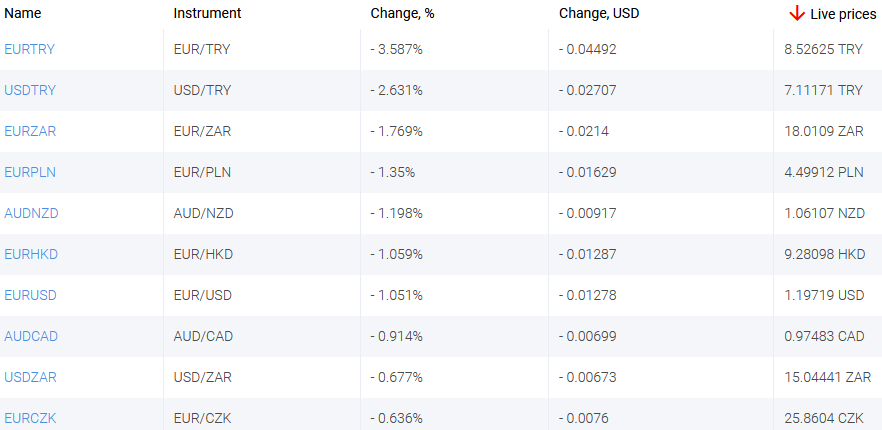

Top Losers – Foreign Exchange Market (Forex)

Top Losers – Foreign Exchange Market (Forex)

1. EURRUB, USDRUB - the drop of these charts means the weakening of the euro and the US dollar against the Russian ruble.

2. USDZAR, USDTRY, USDNOK - the drop of these charts means the weakening of the US dollar against the South African rand, Turkish lira and Norwegian krone.

Alat Analisis Eksklusif Baru

Setiap Rentang Tanggal - dari 1 hari sampai 1 tahun

Setiap Kelompok Perdagangan - Forex, Saham, Indeks, dll.

Perhatian:

Tinjauan ini memiliki karakter informatif dan tutorial dan dipublikasikan secara gratis. Semua data, termasuk dalam Tinjauan, diterima dari sumber publik, diakui kurang lebih dapat diandalkan. Apalagi, tidak ada jaminan bahwa informasi yang ditunjukkan penuh dan tepat. tinjauan tidak diperbarui. Keseluruhan informasi dalam setiap tinjauan, termasuk pendapat, indikator, grafik dan hal lainnya, disediakan hanya untuk tujuan pengenalan dan bukan saran keuangan atau rekomendasi. Seluruh teks dan bagiannya, serta grafik tidak dapat dianggap sebagai tawaran untuk membuat kesepakatan dengan aset apa pun. Pasar IFC dan karyawannya dalam kondisi apapun tidak bertanggung jawab atas tindakan yang dilakukan oleh orang lain selama atau setelah membaca tinjauan.

Last Sentiments

- 18Mar2021Weekly Top Gainers/Losers: Canadian dollar and Japanese yen

Over the past 7 days, prices for oil, non-ferrous metals and other mineral raw materials decreased but still remained high. As a result, the currencies of the commodity countries strengthened: the Canadian dollar, the Australian and New Zealand dollars, the Mexican peso, and the South African rand. The...

- 10Mar2021Weekly Top Gainers/Losers: Canadian dollar and New Zealand dollar

Оil quotes continued to rise over the past 7 days. Against this background, the currencies of oil-producing countries, such as the Russian ruble and the Canadian dollar, strengthened. The New Zealand dollar weakened after the announcement of negative economic indicators: ANZ Business Confidence and...

- 4Mar2021Weekly Top Gainers/Losers: American dollar and South African rand

Over the past 7 days, oil quotes continued to grow. Precious metals, including gold, fell in price. Against this background, the shares of oil companies increased, the Russian ruble strengthened, the Australian and New Zealand dollars, as well as the South African rand, weakened. The US dollar strengthened...