- Edukasi

- Analisis teknis

- Indikator teknis

- Indikator B. Williams

- Indikator Alligator

Indikator Alligator - Bill Williams Alligator

Bill Williams invented many indicators and gave them unique and catchy names, such as Awesome Oscillator, Gator Indicator, Alligator Indicator.

Cara Menggunakan Indikator Aligator

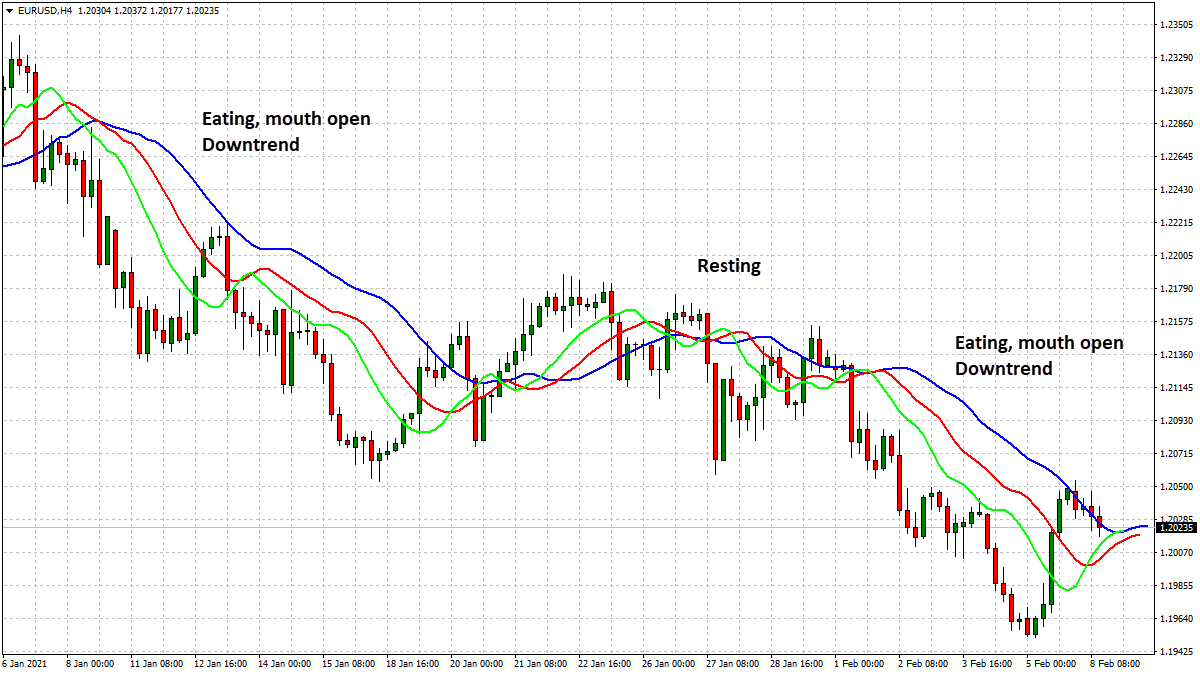

Indiaktor Alligator terdiri dari 13-, 8- dan 5-periode ratarata pergerakan mulus yang kemudian berubah menjadi 8, 5 dan 3 balok secara berurutan yang berwarna biru, merah, dan hijau yang mewakili rahang, gigi, dan bibir buaya.

Alligator beristirahat ketika tiga rata-rata berputar maju bersama-sama dalam kisaran sempit. Semakin jauh rata-rata, semakin cepat pergerakan harga akan terjadi.

Rata-rata terus ke atas (hijau diikuti oleh warna merah dan biru) menunjukkan tren naik yang muncul yang kita artikan sebagai sinyal beli.

Rata-rata berikut satu sama lain dalam urutan terbalik menuruni lereng adalah sinyal kuat dari downtrend yang sedang berlangsung sehingga menjual pada saat ini akan lebih dari tepat.

Alligator Indicator

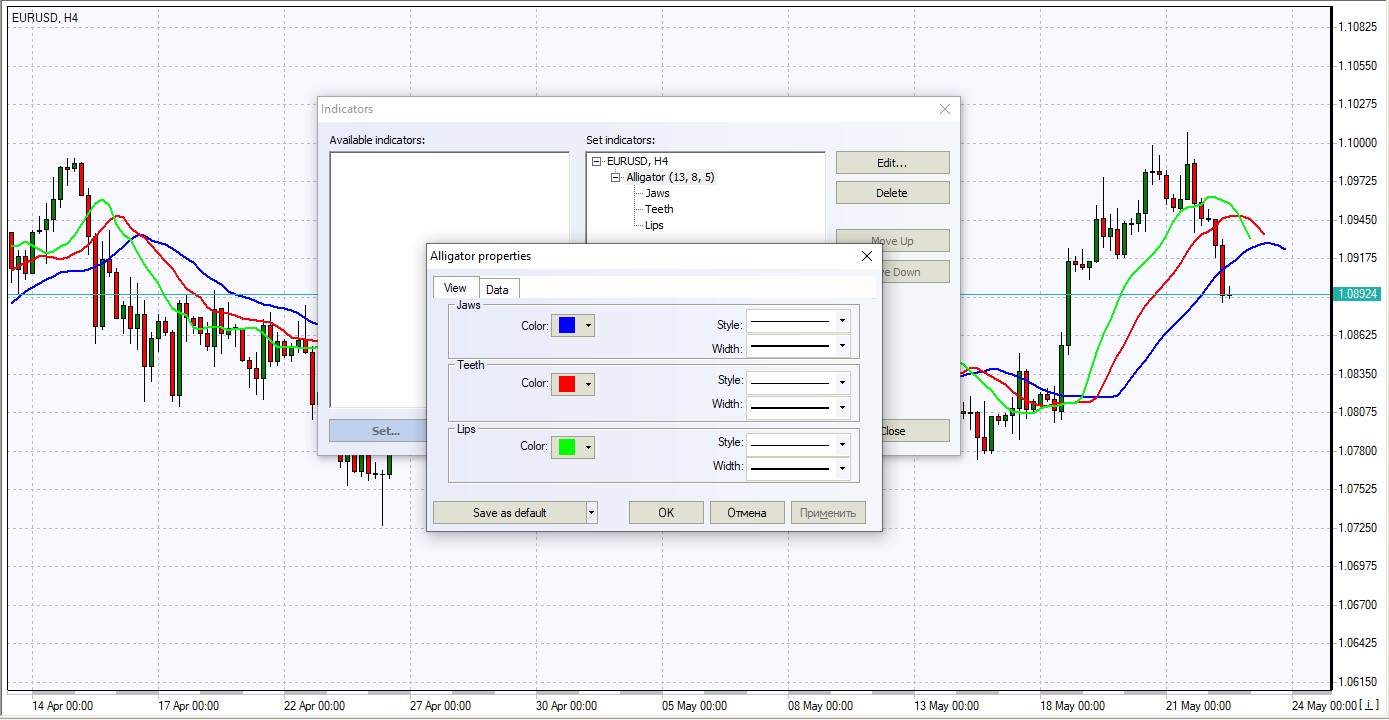

Formula Indikator Alligator (Perhitungan)

HARGA MEDIAN = (TINGGI + RENDAH) / 2

RAHANG ALLIGATORS = SMMA (HARGA MEDIAN, 13, 8)

GIGI ALLIGATORS = SMMA (HARGA MEDIAN, 8, 5)

BIBIR ALLIGATORS = SMMA (HARGA MEDIAN, 5, 3)

Cara menggunakan indikator Indikator Alligator pada platform trading

Forex Indicators FAQ

What is a Forex Indicator?

Forex technical analysis indicators are regularly used by traders to predict price movements in the Foreign Exchange market and thus increase the likelihood of making money in the Forex market. Forex indicators actually take into account the price and volume of a particular trading instrument for further market forecasting.

What are the Best Technical Indicators?

Technical analysis, which is often included in various trading strategies, cannot be considered separately from technical indicators. Some indicators are rarely used, while others are almost irreplaceable for many traders. We highlighted 5 the most popular technical analysis indicators: Moving average (MA), Exponential moving average (EMA), Stochastic oscillator, Bollinger bands, Moving average convergence divergence (MACD).

How to Use Technical Indicators?

Trading strategies usually require multiple technical analysis indicators to increase forecast accuracy. Lagging technical indicators show past trends, while leading indicators predict upcoming moves. When selecting trading indicators, also consider different types of charting tools, such as volume, momentum, volatility and trend indicators.

Do Indicators Work in Forex?

There are 2 types of indicators: lagging and leading. Lagging indicators base on past movements and market reversals, and are more effective when markets are trending strongly. Leading indicators try to predict the price moves and reversals in the future, they are used commonly in range trading, and since they produce many false signals, they are not suitable for trend trading.

Pilihan Platform Perdagangan Terluas untuk Semua Perangkat